The Collaborative Power of the PEO Partnership

Initially perceived as competitors, PEO companies have a rich history dating back to the 1970s. Over time, they have become critical resources for small and medium-sized business owners. This shift in perspective highlights why benefits brokers should consider partnering with a PEO.

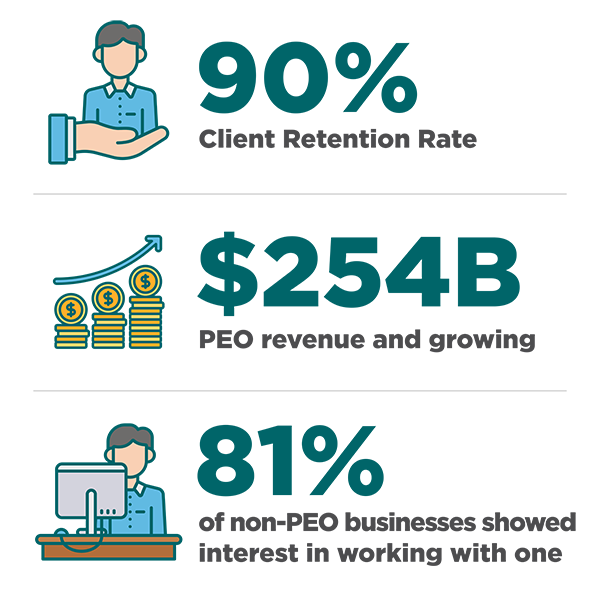

The list of PEO benefits for insurance agents and brokers begin with collaboration. A 2022 survey from the National Association of Professional Employer Organizations (NAPEO) found that the PEO industry has a client retention rate of over 90%. Not only that, but PEO revenue is $254 billion and growing; 81% of businesses that don’t use a PEO reported interest in using one in the future.

Earn Higher Broker Commissions with a PEO: Industry Insights

NAPEO’s annual PEO Industry Footprint survey queries more than 500 business owners and decision makers within the United States to measure the size, scope, and footprint of the PEO industry at the end of every calendar year. In addition to the above, the 2022 survey showed that PEOs co-employ about the same number of employees as the four largest companies in the United States combined.

The annual growth rate of work site employees (WSEs) is now 16 times higher for PEOs than the US economy in general, meaning that brand new clients are pouring in for brokers each day. PEOs like PrestigePEO, that exclusively work with brokers, can help funnel new clients directly to brokers, resulting in higher commissions and overall compensation for PEO brokers.

Professional Employer Organizations provide comprehensive HR services to businesses. PrestigePEO supports the crucial roles of HR business partners, benefits and payroll administration, compliance, and others for small and medium-sized businesses (SMBs). Our licensed health insurance agents and other partnered brokers are essential in helping us to reach those businesses.

The U.S. Bureau of Labor Statistics released a summary of employee benefits in the United States, recapping the percentages of private industry workers who had access to specific types of benefits. It was shown that only 57% of these workers had access to life insurance, only 43% had access to short-term disability insurance, and only 35% had access to long-term disability insurance. Unfortunately, availability and affordability can be at odds for many American workers.

However, there’s a bright side. PEO brokers often play a crucial role in bridging gaps in access to healthcare and other health benefits. Partnering with a PEO empowers PEO brokers to impact client organizations significantly and, consequently, increases the amount of commission benefits brokers can earn.

2019 research by Laurie Bassi and Dan McMurrer of McBassi & Company showed that new PEO clients often add a variety of new benefits for their employees, including life insurance (26%), retirement plans (26%), and health benefits (26%). The best PEO companies offer guaranteed competitive market commissions rates for the lifespan of each client relationship. Some, such as PrestigePEO, offer PEO broker commissions on administrative fees and multiple products including life insurance, retirement plans, health benefits, and disability insurance.

The PEO benefits for insurance agents and brokers only begin with driving higher commission. Though many PEOs may appear to offer “apples to apples” perks, make no mistake: a well-established professional employer organization offers far more than an opportunity to merely earn an above-average PEO broker salary.

How Brokers Can Learn How to Sell PEO Services

1. PEO Clients See an Average ROI of 27.2%

The 2019 white paper, The ROI of Using a PEO found that when looking at cost savings alone, the annual return on investment for clients who use a PEO is 27.2%. Key cost savings were found in the following areas:

- HR personnel costs

- Health benefits

- Workers’ compensation

- Unemployment insurance

- Other external expenditures related to HR services such as payroll services and other benefits.

2. PEO Clients Achieve Higher Growth Rates and Lower Employee Turnover

The same research study reported that there are higher rates of employee and business revenue growth as well as notably lower voluntary and involuntary employee turnover.

- Year-over-year (YOY) business revenues for PEO clients are higher by 5%

- YOY employee growth rates for PEO clients are higher by 4.2%

- Total YOY turnover for PEO clients is lower by 19.6%

3. PEO Clients Worry Less

If cost savings, revenue growth, and employee retention weren’t enough, PEOs are experts in risk mitigation, administrative support, and employee-related challenges. Business owners in the enrollment process were asked to identify their top potential business challenges and three categories were identified by the majority of respondents. Here are the findings:

- PEO clients worry 25% less about hiring employees.

- PEO clients worry 17.6% less about retaining employees.

- PEO clients worry 5.3% less about motivating employees.

An important aspect of PEO benefits for group and individual health insurance brokers and general agents is being able to leverage their PEO partners’ ability to deliver a smoother client experience. This creates potential for increased client satisfaction and referrals for the broker.

Secure a Competitive Edge: How PEO Partnerships Differentiate Brokers

Research shows that business owners and HR business partners are more successful with a PEO. Contrary to , PEOs also help support business growth for licensed health insurance agents and brokers as well.

Another key PEO benefit for insurance agents is differentiation in the field. Right now, thousands of benefit and insurance brokers do not offer comprehensive HR services as an option. As awareness of a lower cost, more convenient source of diversified benefits and services grows among business owners, a broker who has the option to recommend more HR solutions to their client will stand out, especially if they represent a trustworthy organization that maintains the industry’s highest-standard certifications and accreditations. Partnership shows that brokers are associated with prominent organizations, which can also lend a broker’s business more authority with prospects.

By leveraging your additional opportunities and resources. you become an expert in all things HR services, workers’ compensation, compliance, and benefits. Working with a PEO gives you a deeper understanding of the nuances of the HR and employee benefits landscape and enables you to position yourself as a trusted advisor who can cater to the distinctive needs of each of your clients. When PrestigePEO enters a new partnership with a broker, a PrestigePEO Business Development Manager will work with them personally to equip brokers with all the information they need to begin quoting.

PEO Benefits for Insurance Agents & Brokers: Building a Legacy Beyond Commissions

Go beyond cookie-cutter offerings by working with a PEO that gives you the power to craft HR services and benefits offerings that align with the unique needs of each of your client’s workforce. Whether it’s ensuring access to vital health care during challenging times, retirement planning for a secure future, or helping attract top talent to foster business growth, PEOs help brokers provide the tools and resources their clients need to make a meaningful difference in employees’ lives. As you know, it’s always been about more than just benefits; it’s about securing your clients’ and their employees’ well-being and satisfaction.

PEO partnerships will transform the way you serve your clients. The broker-PEO relationship offers more than just commissions or transactional benefits; they’ll enable you to provide more comprehensive solutions beyond traditional benefits offerings. It offers insurance agents the ability to make a lasting impact on businesses, employees, and your own professional growth in the future.

Brokers interested in partnering with PrestigePEO can visit us at www.prestigepeo.com/for-brokers, or they can contact us directly by phone at 888-PEO-PEO1 or by email at brokerpartner@prestigepeo.com.