The latest news relevant to you and your business

PrestigePEO is continuously improving your experience with the latest in HR technology. Our Chief Technology Officer, Joe Dodgson, has shared updates on the latest enhancements and what’s coming next.

As the Chief Technology Officer (CTO) of PrestigePEO, it is essential to stay updated on the latest advancements in technology and software solutions. I’m happy to share the following updates to keep you informed on the latest developments.

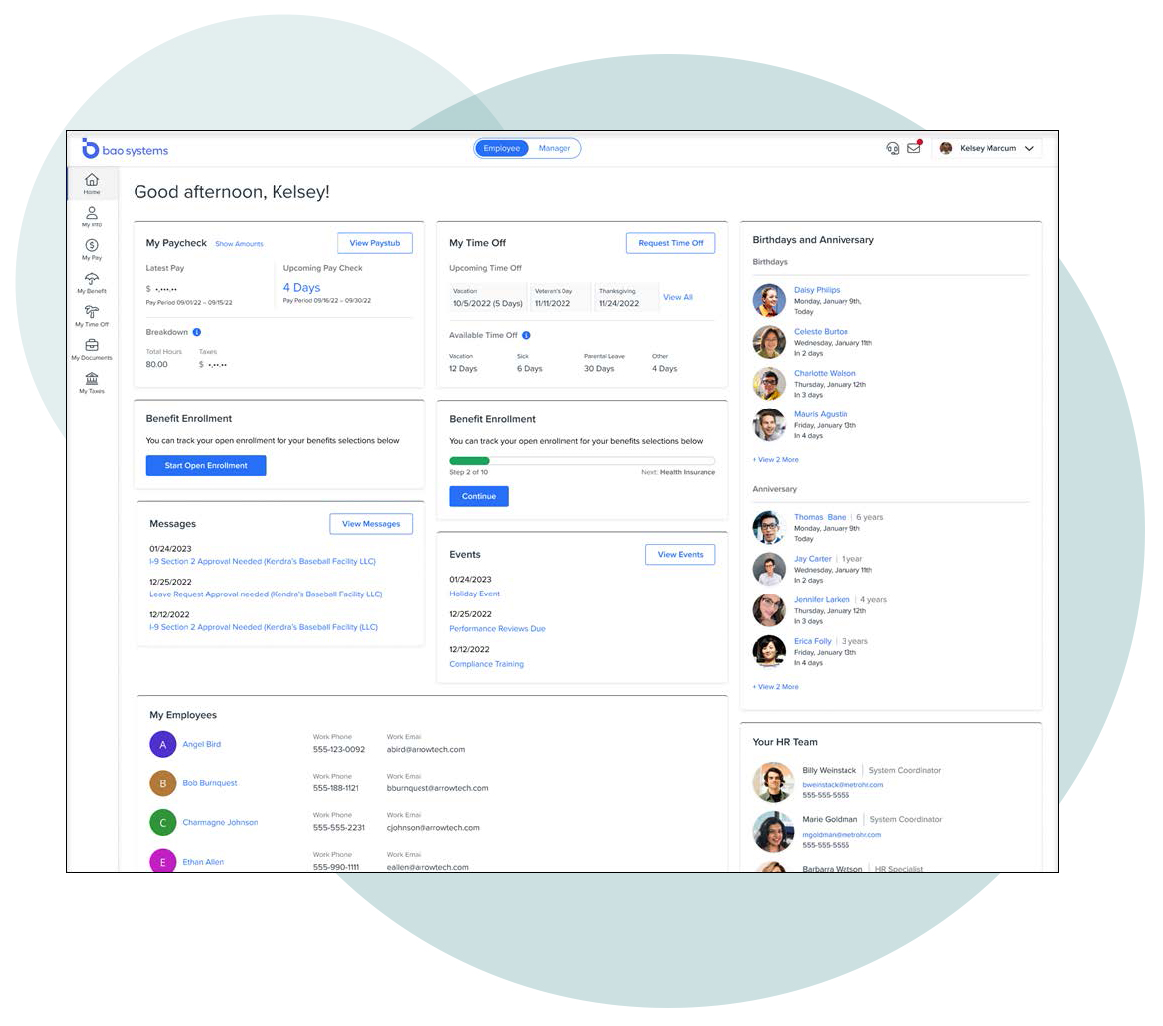

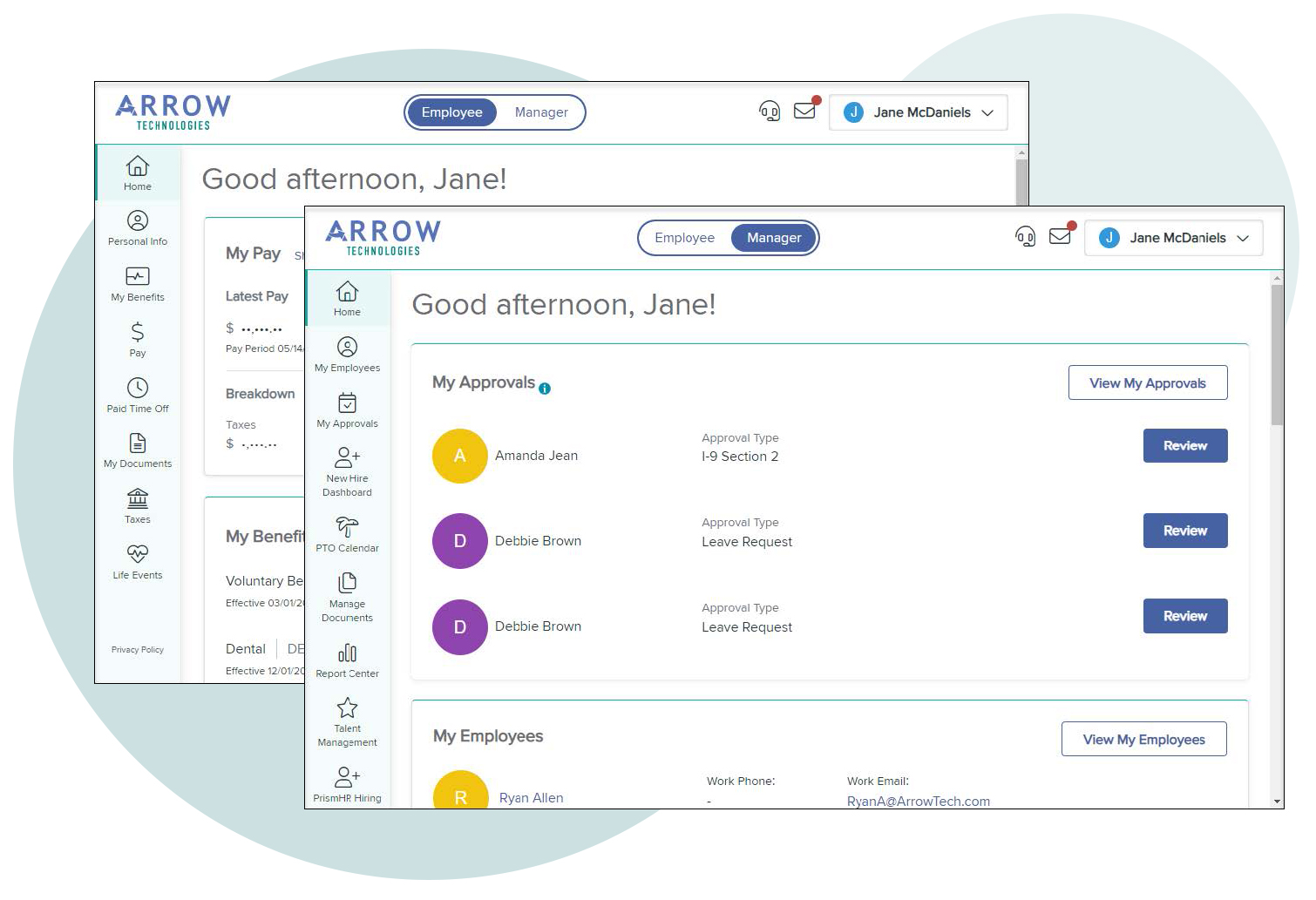

We are excited to announce that our PrestigePRO technology interface is about to undergo a significant upgrade. The upcoming Unified Employee Experience (UEX) will introduce a sleek and modern appearance along with an intuitive design. Users will benefit from more responsive navigation and guided workflows, making their journey through our applications faster and more straightforward. This enhancement aims to provide our employees and clients with a seamless and enjoyable experience.

All dashboard widgets will be updated for a sleek, modernized appearance and improved functionality. In addition, several widgets will be redesigned from the ground up for improved

functionality, including the Paid Time Off widget, the My Benefits widget, the Pay widget, and the Birthdays & Anniversaries widget.

Our focus on intuitive design, streamlined workflows, and personalized features is geared toward maximizing your productivity while minimizing any user frustrations. Starting with Onboarding, Benefits Enrollment, Employee Portal, and Talent Management, you can expect improved speed, enhanced functionality, and an overall better user experience. But we’re not stopping there! In the coming months, we plan to extend the new UEX designs to even more areas within PrestigePRO.

Currently, the new UEX is in the testing phase, and we anticipate its official rollout in January 2024. We’ll keep you posted on our progress and give you a final announcement about the release of this exciting update.

Once again, we appreciate your trust in our services. We sincerely hope that these PrestigePRO enhancements contribute value to your user experience, and we eagerly await your feedback. Should you have any questions or concerns, please don’t hesitate to reach out to me directly at jdodgson@prestigepeo.com.

Joe Dodgson

PrestigePEO, CTO

HR CORNER

Remember to Complete Your Sexual Harassment Training

As we approach the year’s end, it’s an opportune moment to begin preparations for your annual sexual harassment training for employees. If your company operates in California, Connecticut, Delaware, Illinois, Maine, Massachusetts, or New York, it’s essential to note that your state mandates sexual harassment training. These state requirements can differ in terms of the training’s content, duration, and frequency. For personalized guidance, please reach out to your dedicated HR Business Partner.

In cases where your company has offices in multiple states and employees working remotely, you must ensure compliance with the various sexual harassment training requirements of each state. Even if your particular state doesn’t impose mandatory sexual harassment training, we strongly recommend providing it as a proactive measure for the well-being of your team members. Your HR team is well-equipped to assist you in developing a training program that is both in compliance with regulations and effective.

HSA, FSA, and HRA accounts offer pre-tax benefits that enable employees to allocate funds for the reimbursement of medical expenses incurred out-of-pocket. The FSA is open to enrollment for all employees who choose to participate. To assist you and your employees in comprehending the distinctions between these accounts, we have provided a useful comparison document linked below.

Enrolling in HSA, FSA, and HRA is an integral part of your employees’ Open Enrollment process, and it will remain accessible through your Benefits Renewal Portal until 12/1. Employees interested in enrolling after this date are encouraged to reach out to their Benefits Specialist for assistance.

Reminder – Review Our New Voluntary Benefits!

Don’t forget to make the most of our voluntary benefits plans during this Open Enrollment season! You can find a summary of this year’s newly introduced voluntary benefits in our Open Enrollment Resource Center, along with a wealth of other valuable information. Simply click the button below to explore these new plans and services.

Recognizing the Importance of Mental Health Benefits

Mental health benefits are hugely important, and it’s a good idea to reiterate the valuable resources accessible to your employees. National EAP extends an Employee Assistance Program that encompasses consultation and evaluation, counseling services, crisis support, and a range of additional offerings. Furthermore, National EAP provides leadership coaching, anger management courses, harassment prevention training, and more.

If your company is currently enrolled with National EAP, you can access their website using your company name as both your username and password. For those considering enrollment in this service, contact your HR Business Partner for additional information.

State-Mandated Retirement Plan Deadlines

The United States is currently grappling with a retirement crisis. Alarmingly, close to a quarter of working adults have no retirement savings, and this issue is expected to exacerbate as younger generations approach retirement. To address this concern and promote retirement savings, several states have crafted legislation mandating that employers of a certain size must provide a retirement savings plan.

Now, more than ever, it is crucial to understand the requirements applicable to your business and to identify the most suitable retirement plan for both you and your employees.

Please consult the chart below to ascertain whether your business falls under these regulations. Additionally, we encourage you to join our upcoming webinar tomorrow October 18, at 11:00 a.m. to gain deeper insights into the significance of offering a retirement plan to your employees. Register here.

COMPLIANCE

PrestigePEO Presents: EPLI Best Practices for Protecting Your Business

Employment Practices Liability Insurance (EPLI) plays a vital role in safeguarding your business against employment-related claims, such as wrongful termination, discrimination, and harassment. It’s essential for business owners to have a comprehensive understanding of the scope of EPLI coverage and how to fortify their organization against these potential claims.

In our upcoming webinar, Elisabeth Shaw, PrestigePEO’s VP of Corporate Counsel, and Colleen Higley, our Director of HR Services, will deliver an informative presentation, offering an in-depth exploration of EPLI insurance and sharing best practices to help protect your business.

The webinar will be offered on Wednesday, October 25, 2023, at 10:00 a.m.

Election Day is Coming Soon – Remember to Post Voting Rights Notices!

As Election Day rapidly approaches, it’s essential for employers to familiarize themselves with the voting leave laws relevant to their respective states. While the majority of states mandate that employers grant a few hours of leave for voting, some states go a step further by requiring the posting of notices regarding employees’ voting rights in a conspicuous workplace location. In cases of remote employees who do not regularly report to a physical workplace, these notices can be distributed electronically.

As part of our commitment to our clients, PrestigePEO ensures that the required notices are incorporated into poster subscriptions and are accessible for all employees through the employee portal. To learn how to access the necessary posting notice requirements, kindly click the button below.

California – New Background Check Requirements Effective October 1, 2023

California’s Fair Chance Act has been in place since 2018 and prohibits employers from asking an applicant about their criminal history until after the employee receives a conditional offer of employment from the employer. Starting October 1, 2023, additional regulations go into effect under the Act impacting employers. The new regulations impacting employers are as follows:

Prohibited Activity:

- Employers cannot consider information voluntarily provided by an applicant about the applicant’s criminal history prior to the applicant receiving a conditional offer from the employer.

- Employers cannot include language that people with a criminal history will not be considered for employment in job advertisements, job applications, job postings, or other recruiting materials.

Required by Employers:

- Employers must consider evidence provided by an applicant of rehabilitation and/or mitigating circumstances. The Act includes non-exhaustive examples of such factors for employers to consider which can be found here.

- Employers need to conduct an individualized assessment of individuals with a criminal history and, at a minimum, must consider numerous, non-exhaustive subfactors as part of the individualized assessment, which can be found here.

- Employers must wait five (5) business days after an individual receives a pre-adverse action letter sent by the employer prior to the employer taking action and making its final decision. If an employer is unable to show when the individual received the letter, the employer must assume timing of receipt of the letter based on how it was sent to the individual:

- Mailed to California Address: five (5) business days

- Mailed to US Address not in California: ten (10) calendar days

- Mailed to International Address: twenty (20) calendar days

- Emailed: two (2) business days

Updated Definitions:

- Employer – includes direct employers, entities acting as agents or evaluating applicants’ criminal history on behalf of a direct employer, entities obtaining workers from a pool or availability list, and staffing agencies.

- Employee – new job applicants, current employees applying for a different position within the company, as well as employees who undergo background checks due to an internal policy change, change in management, or a change in ownership.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. If you have any questions regarding California’s Fair Chance Act additional regulations or any other workplace policies, please reach out to your HR Business Partner.

California's New Marijuana Testing Law

Effective January 1, 2024, it is unlawful for employers in California to discriminate against an applicant or employee for their use of marijuana away from the workplace and for employers to discriminate against an applicant or employee for non-psychoactive cannabis metabolites appearing on an employer-required drug screening.

Non-psychoactive cannabis metabolites may remain in an individual’s system for weeks after the psychoactive component of marijuana has been metabolized by the individual’s body. Drug tests that show such remnants of marijuana use are no longer able to be used by employers for pre-employment drug screening nor can such drug tests be the basis for employee discipline or termination. However, this protection does not extend test results that indicate a present impairment and/or the presence of the psychoactive chemical of marijuana in an applicant’s or employee’s system. Employees or applicants who are positive for the psychoactive chemical of marijuana are not afforded the same protections against employee discipline.

Exemptions under this law include:

- Employees hired for positions requiring federal background and clearance checks; and/or

- Employees in the construction or building industries.

This law does not allow for employees to be impaired on the job; rather, it provides increased protections to those who recreationally use marijuana outside of the workplace and on their own time. Employers still maintain a right to enact and enforce drug and alcohol-free workplaces.

PrestigePEO is here to help.

If you have questions regarding cannabis employment testing or updating your drug and alcohol policy, please reach out to your HR Business Partner.

Expanded Illinois Bereavement Leave – Child Extended Bereavement Act

Effective January 1, 2024, Illinois has expanded bereavement leave rights by enacting the Child Extended Bereavement Act. This Act extends bereavement leave rights to parents who have lost a child due to suicide.

Employees who experience the loss of their child by suicide or homicide are afforded unpaid leave to grieve their loss and the time afforded to them is dependent upon the size of their employer. For “small” employers, those with 50 to 250 employees, qualified employees are entitled to six weeks of unpaid leave. Employees working for “large” companies, those with 250 or more full time employees, are entitled to twelve weeks of unpaid leave. Employees may elect to take their leave continuously or intermittently. Should an employee choose to take intermittent leave under this Act, they may do so in increments of at least four hours. Employees may take leave under this Act within one year of the employee notifying the employer of their loss.

As an employer, you may require employees seeking to take leave under the Child Extended Bereavement Act:

- To provide reasonable advance notice of their intention to take leave under the Act – however, keep in mind that there may be instances where an employee providing such notice may be unreasonable or impractical.

- To require an employee to provide reasonable documentation that includes cause of death.

If an employee has other paid or unpaid leave options available to them, the employee may choose to substitute other available leave options for an equivalent period under this Act. Additionally, Employees who take leave under the Child Extended Bereavement Act are not entitled to take additional leave for the same child under the Illinois Bereavement Act.

Expanded Victim’s Economic Security and Safety Act (VESSA)

Effective January 1, 2024, Illinois will expand VESSA leave rights to allow for employees to take up to ten workdays of unpaid leave relating to the death of a family or household member who was killed in a crime of violence.

The expanded leave allows employees to take leave under VESSA for the purpose of attending the funeral, funeral alternative, or wake of the family or household member; to make arrangements needed due to the death of the family or household member; and to grieve the death of the family or household member. Employees seeking to take leave under VESSA must do so within 60 days after the employee receives notice of the victim’s death. Employers may require the employee seeking to take leave under VESSA to produce certification of the death of the family or household member.

Additionally, if the employee seeking to take leave under VESSA also qualifies for unpaid leave under the Family Bereavement Leave Act, leave under the Family Bereavement Leave Act shall not diminish the leave afforded to the employee under VESSA.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. Should you need assistance with updating your company bereavement policies, or if you have any questions regarding the Child Extended Bereavement Leave Act or the amendments to the Victim’s Economic Security Act (VESSA), please reach out to your HR Business Partner.

Misclassifying Independent Contractors Causes Major Consequences for Businesses

Companies sometimes misclassify their workers as independent contractors when they should be classified as employees. Not only does the type of classification entitle the individual to certain rights, but it also dictates how companies must handle employment taxes. The Federal Labor Standards Act (FLSA) and the National Labor Relations Board (NLRB) have standards for classifying workers to determine which workers are entitled to certain rights. The Internal Revenue Service (IRS) enforces the tax payments and deductions employers must make when working with employees.

Correctly Classify Your Workers, or Else You May Be Denying Them Their Rights

The FLSA, the federal law regulating minimum wage, overtime pay eligibility, and recordkeeping for employees, has a standard used to determine whether a worker is an independent contractor or employee called the economic realities test. A worker who is economically dependent on the company they serve is an employee, while a worker who is in business for himself is an independent contractor. To determine the economic reality of the worker under the FLSA, the U.S. Supreme Court considers several factors, including (1) the extent to which the services provided are an integral part of the employer’s business, (2) the permanency of the relationship; and (3) the nature and degree of control the business has over the individual’s work. The above are some, but not all the factors. For more information on how the FLSA determines whether a worker is an employee or independent contractor, you may visit the FLSA’s Fact Sheet. Under the FLSA, a worker who is considered an employee is entitled to a minimum wage or minimum salary, and they may be entitled to overtime pay. Misclassifying employees as independent contractors could mean that these individuals are not receiving the wages they are due. It also may mean that the company fails to take certain steps to protect itself, such as properly tracking employee hours.

In addition, the NLRB provides certain protections and benefits for employees that would not be available to independent contractors, such as the right to unionize. Therefore, the NLRB has its own test for determining whether an individual is an employee or an independent contractor: does the worker have actual entrepreneurial opportunity, and are there limitations that the company imposes on the individual when pursuing this entrepreneurial opportunity? Amongst other factors, some of the factors that the NLRB considers are whether the work is usually done under the direction of the employer, how much skill is required for that particular job, and whether the work is a part of the regular business of the employer. If, under this test, the individual was to be considered an employee, then the employee would have rights under the National Labor Relations Act, including the right to be part of a union. If a company were to deny these rights to someone who should be classified as an employee, it would be considered an unfair labor practice. The employer would then be mandated to compensate affected employees for the damage it caused.

Worker Classification Determines Tax Deductions and Other Payroll Deductions

Whether a worker is classified as an “independent contractor” or as an “employee” matters when processing payroll. Misclassifying workers can lead to issues with the IRS if the employer is not withholding taxes from the appropriate individuals, issuing the correct tax forms, or paying unemployment taxes. Also, depending on whether the worker is an employee or an independent contractor, they may be eligible for benefits. The following demonstrates the differences in payroll management between employees and independent contractors:

Employee

The employer must issue the employee a W-2.

Independent Contractor

The company must issue the independent contractor a Form-1099.

The employee may be eligible to receive company benefits (e.g., health insurance), which would be deducted from their paycheck.

The company does not need to provide company benefits.

The employer deducts employment taxes from the employee’s paycheck, such as federal income taxes, Social Security taxes, Medicare taxes, federal unemployment taxes, and any applicable state income and unemployment taxes.

The company does not deduct employment taxes from an independent contractor’s pay. The independent contractor is responsible for self-employment taxes.

For more information on tax obligations, you may visit the IRS Website.

Treat Employees and Independent Contractors Accordingly

Once you have correctly classified your workers, treat employees and independent contractors accordingly. For instance, when assigning workplace training, be mindful of their classification. Most of your internal policies, procedures, and trainings are not going to apply to your independent contractors.

Consequences of Misclassifying Workers

The consequences for misclassifying an individual as an independent contractor may result in significant civil penalties, attorney’s fees, and damages, such as paying the affected worker any unpaid overtime compensation. From a tax perspective, if you misclassify an employee, the IRS may hold your company liable for the employment taxes and you may face penalties. The company may also be at risk of a class action lawsuit, which could damage the business’s reputation. While independent contractors can be used in some situations, companies need to be strategic in how they use them and make sure they aren’t circumventing established employment laws for convenience.

PrestigePEO is here to help.

If you have any questions about employee classifications, please reach out to your HR Business Partner.

New York City Safe and Sick Time Regulation Amendments

The New York City Department of Consumer and Worker Protection has adopted several new amendments to the City’s regulations of its Earned Sick and Safe Time Act (ESSTA). The amendments will be effective October 15, 2023.

The new regulations include the following important changes:

Who is an employee under the ESSTA?

The regulations provide additional guidance for employers of telecommuters and hybrid workers. If an employee is regularly performing or expected to perform work in New York City during the calendar year, then they are covered by the ESSTA for the work they perform while working in the City. If, however, they are not coming into the City, or their hours worked in the City are de minimis in nature, the employer will not have to provide ESSTA leave.

The amendments provided several examples to illustrate whether a hybrid employee is entitled to ESSTA, which can be found on page 5 of the regulations. Here are two examples provided by the City:

Example 1: A retail business based in New Jersey with locations in both New Jersey and New York City hires a new employee. The employee, who lives in New Jersey, will work primarily at a New Jersey location but may be asked to cover shifts in New York City when needed due to staffing shortages at those locations. The employer estimates that some months, the employee will work one to three six to eight-hour shifts in New York City, but that their New York City hours will vary and some months the employee may not work in New York City at all. This is work that the employer expects the employee to perform regularly, so the employee is employed for hire within the City of New York for the purposes of section 20-912 of the Administrative Code. The employee must accrue one hour of safe/sick time for every 30 hours worked within New York City and must be allowed to use their accrued hours for the reasons provided by section 20-914 of the Administrative Code when scheduled to work within New York City.

Example 2: An employee lives in Florida and works from home for a company based in Manhattan. The employee is required to attend daylong meetings at the Manhattan headquarters approximately twice a year. The employee is not “employed for hire within the City of New York” under section 20-912.

How does an employer determine its employer size under the ESSTA?

The regulations clarified that NYC employers with 100 or more employees nationwide are required to provide up to 56 hours of ESSTA leave to employees working in NYC. NYC employers with less than 100 employees nationwide have to provide up to 40 hours of ESSTA leave to employees working in NYC.

What is foreseeable leave?

Employers have always been able to require supporting documentation of the need for leave if the leave is foreseeable. The regulations clarify that leave is foreseeable if the employee knows about the need for leave seven (7) days or more in advance. Any time less than seven (7) days is considered unforeseeable.

Do employers need to update their ESSTA policy?

Maybe. If an employer requires that employees provide reasonable notice of the need for ESSTA, then the policy must include the requirement and the method by which the employer will require notification (for example, phone call, text, email). If an employer requires the submission of supporting documentation of the need for ESSTA, then the employer must now also specify what documentation is required and how employees can submit documentation. Employers must also include a confidentiality statement regarding the employee’s medical information if they do not already have one.

PrestigePEO is Here to Help.

If you are PrestigePEO client with employees working in New York City and you need an ESSTA policy, please reach out to your Human Resources Business Partner. We have also included some sample policies you can use here and here. Please note that your policy will vary based on whether your company front loads or accrues ESSTA.

PRODUCT CORNER

TIMECO: Timekeeping Made Easy

Searching for a streamlined time-tracking solution? Allow us to introduce TIMECO: a user-friendly, customizable, and precise platform! It boasts a personalized dashboard that caters to your specific requirements, effectively curbing time theft, reducing errors, and eliminating superfluous paperwork. To delve deeper into the benefits of TIMECO, please explore the details in the flyer linked below.

Feedback

If you have an idea for a future newsletter, we’d love to hear from you! Additionally, if you’d like more information on our services or programs, we can certainly accommodate that as well. Email marketingteam@prestigepeo.com today!